will capital gains tax rate increase in 2021

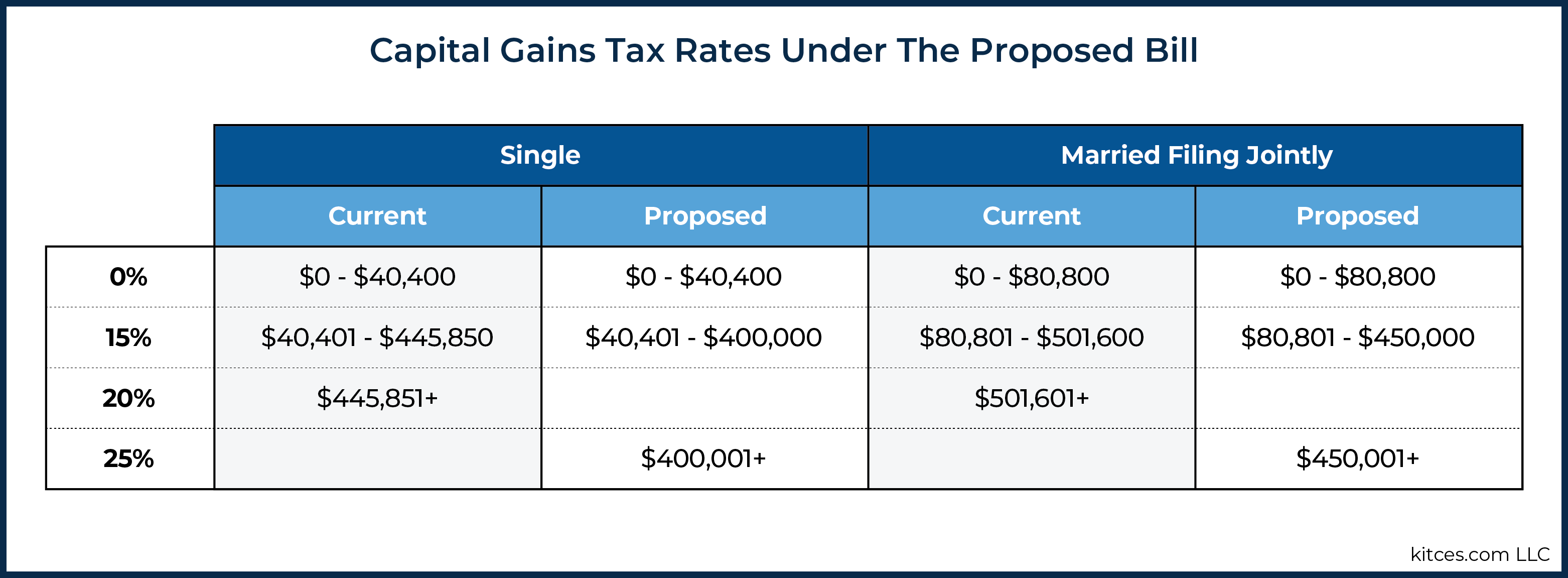

Web If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you up to the 15 long-term capital gains tax rate if not for the. Web House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means.

What S In Biden S Capital Gains Tax Plan Smartasset

Assume the Federal capital gains tax rate in 2026 becomes.

. Web The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. From April 2025 electric vehicles. Web Implications for business owners.

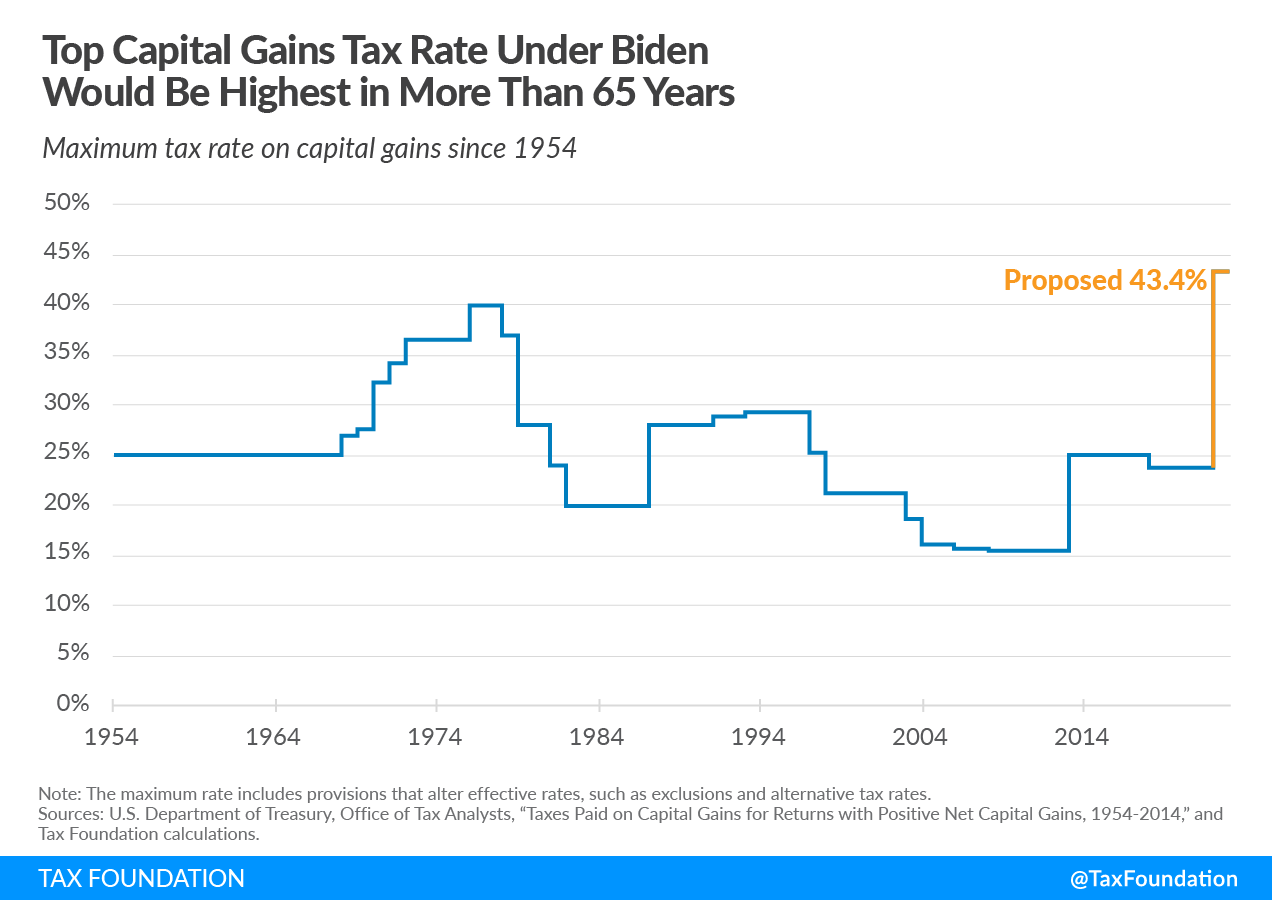

0 15 and 20. Web In todays Autumn Statement the Chancellor Jeremy Hunt announced that the annual exempt amount for capital gains tax will be cut from 12300 to 6000 next. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

Web The 45p rate of tax threshold has been reduced from 150000 to 125140. Capital gains tax will be cut. Increase Tax Rate on Capital Gains Current Law.

Web A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Beyond the deadline for the 2021-22. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher.

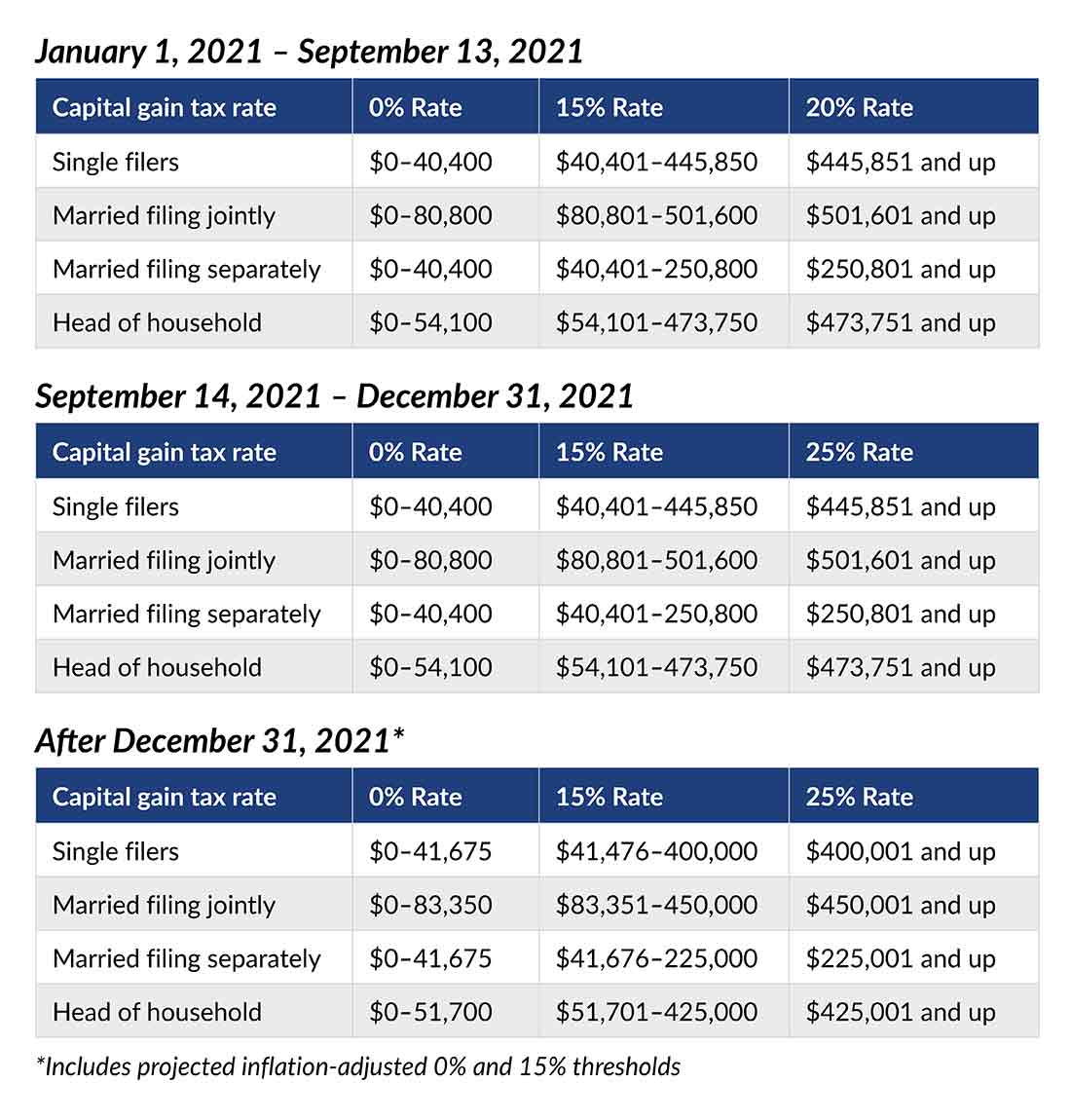

Web But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. The effective date for this increase would be September 13 2021. Web Capital Gains Tax.

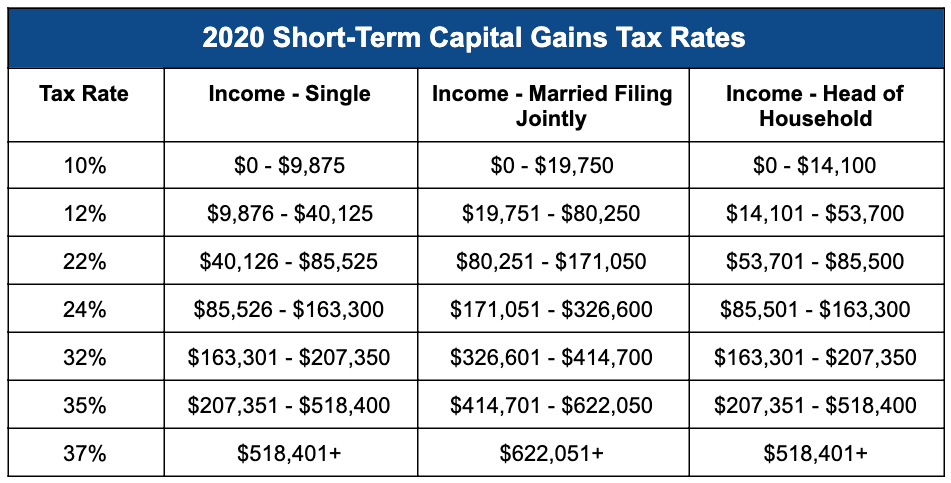

Web Key Points. By Charlie Bradley 0700. Long-term capital gains are taxed at only three rates.

Note that short-term capital gains taxes are even. Web In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. HMRC took a record 61 billion from the tax in 202122 14 per cent more than.

The Chancellor will announce the next Budget on 3 March 2021. Web Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. However it was struck down in.

Web Tens of thousands of Britons will pay capital gains tax for the first time after changes announced in the Autumn Statement. Web A cut in the Capital Gains Tax threshold from 12000 to 6000 meanwhile is set to hit those with their cash outside ISAs and pensions tax wrappers who will now. These are currently 10 at the basic rate and 20 at higher and additional rates although these are 18 and 28 for disposals of residential.

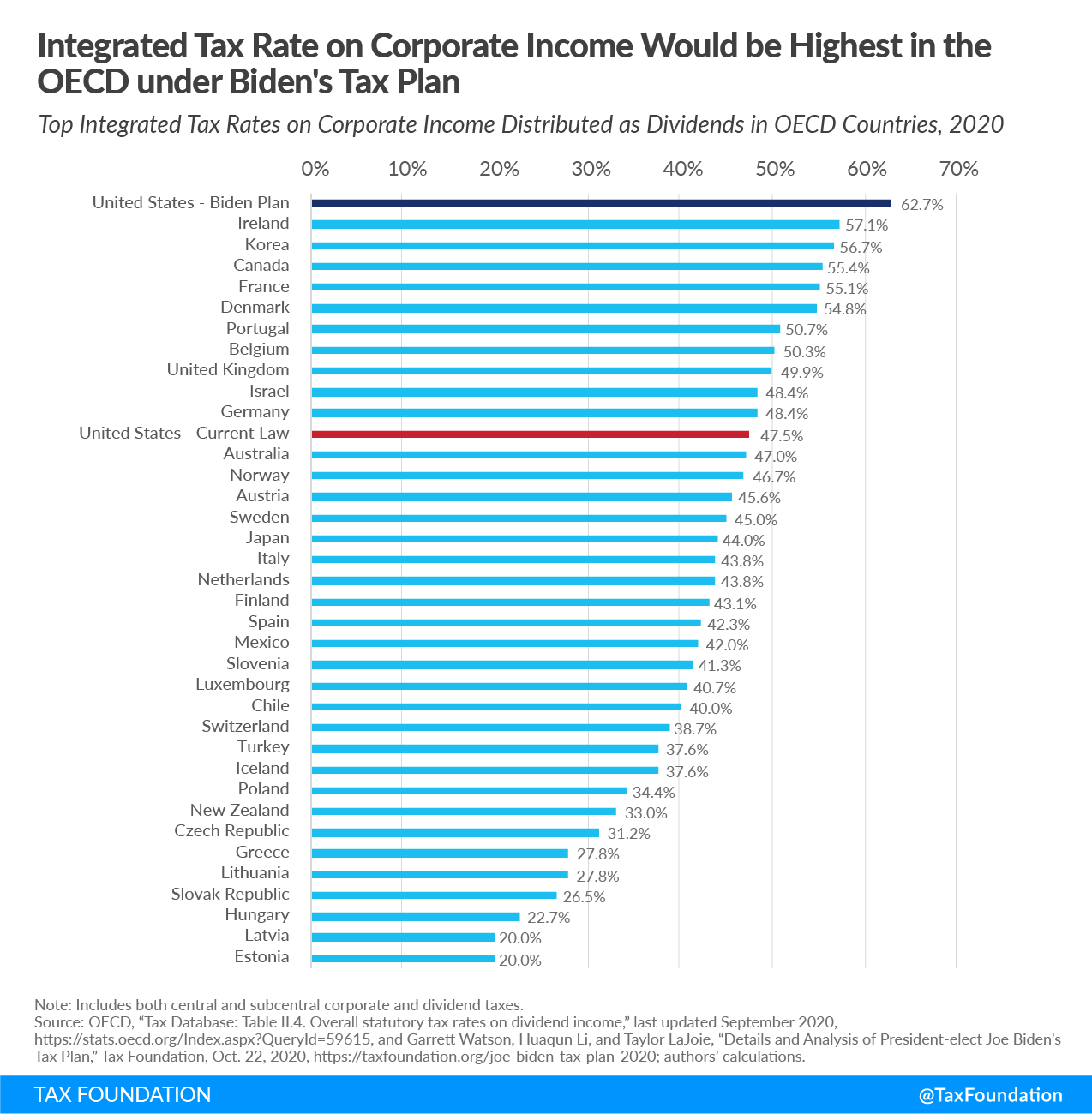

Web Mr Hunt also announced that those earning more than 125140 will onw pay the top rate of income tax down from 150000. Web The proposal would increase the maximum stated capital gain rate from 20 to 25. With average state taxes and a 38.

Web The proposal would be effective for taxable years beginning after December 31 2021. Web The annual exempt amount for capital gains tax will be cut from 12300 to 6000 next year and then to 3000 from April 2024. Weve got all the 2021 and.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Many speculate that he will increase the. Web CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

Web Short-term capital gains are taxed at your ordinary income tax rate.

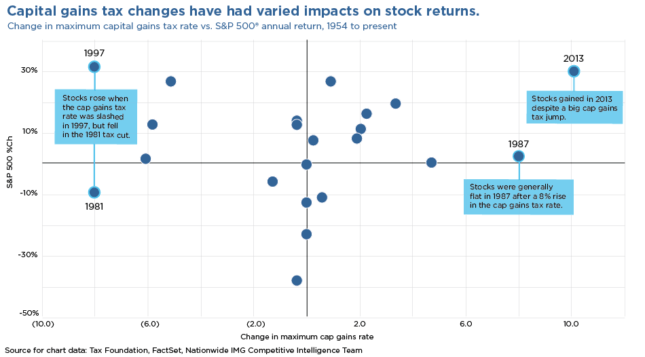

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

The Proposed Changes To Cgt And Inheritance Tax For 2022 2023 Bph

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Managing Tax Rate Uncertainty Russell Investments

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Paying The Piper The Impact Of An Increased Capital Gains Tax Rate When Selling Their Business Rocky Mountain Business Advisors

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

How You Might Prepare For Higher U S Taxes Chase Com

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What You Need To Know About Capital Gains Tax

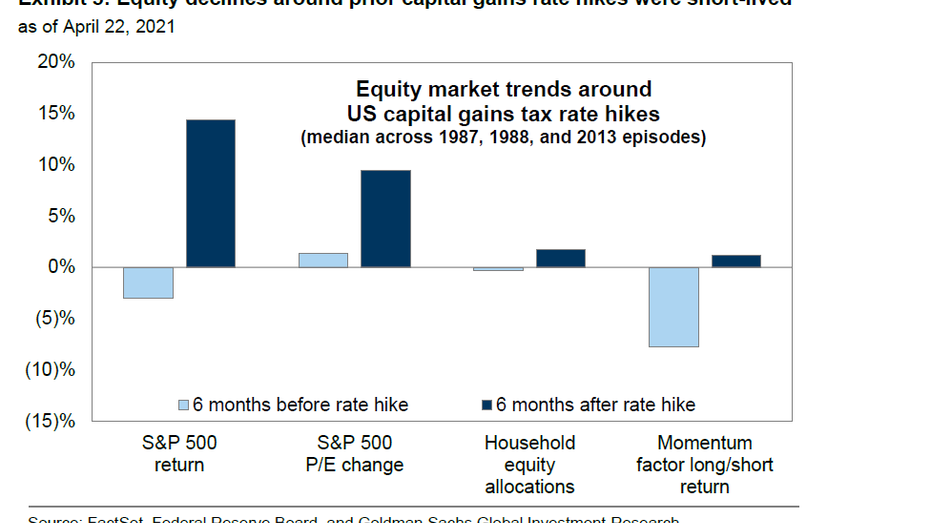

Capital Gains Tax Hikes And Stock Market Performance Fox Business

Short Term Capital Gains Tax Rates For 2022 Smartasset

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Tax Foundation On Twitter President Elect Joe Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains